Optimize your business: use unlimited savings with Pazago fulfilled now!

Get Started ->In global trade, goods do not always move to the same party that pays for them. Many export and import transactions involve separate buyers, delivery locations, and invoicing arrangements. This is where the bill to ship to the model becomes critical.

For Indian exporters and importers, this model is widely used in third-party exports, drop shipments, contract manufacturing, and multi-location supply chains. However, incorrect handling of bill-to and ship-to details can lead to tax mismatches, documentation errors, and customs delays.

This guide explains how the bill to ship to model works, its role in trade documentation, tax and compliance implications, and how businesses can manage it accurately at scale.

Key Takeaways

- The bill to ship to model separates payment responsibility from physical delivery, making it essential for modern, multi-location supply chains.

- The model supports third-party exports, contract manufacturing, drop shipments, and centralised procurement without restructuring contracts.

- Tax treatment depends heavily on the place of supply rules, GST or VAT classification, and the accuracy of export documentation.

- Centralising orders, documentation, and shipment tracking significantly improves audit readiness, operational control, and scalability.

- Pazago simplifies Bill to Ship to execution by keeping billing clarity, delivery coordination, and logistics activity aligned throughout the shipment lifecycle.

What Is the Bill To Ship To Model in Global Trade

The Bill To Ship To model addresses this by separating the party responsible for payment (bill-to) from the party receiving the goods (ship-to). Simply put, one entity handles the payment while another takes delivery. In global trade, businesses often need flexibility in how they manage orders and deliveries.

This approach is especially common in complex supply chains involving distributors, overseas buyers, group companies, or end customers in different locations.

With international trade becoming increasingly fragmented, correctly implementing this model ensures operational efficiency, smoother customs clearance, and compliance with tax regulations.

Once the structure is clear, the next question is why businesses rely on this model so widely across cross-border and multi-location supply chains.

Why the Bill To Ship To Model Matters and Its Advantages?

As businesses expand across borders, the need for flexible delivery and billing structures becomes critical. The Bill To Ship To model allows companies to meet these demands while maintaining financial clarity.

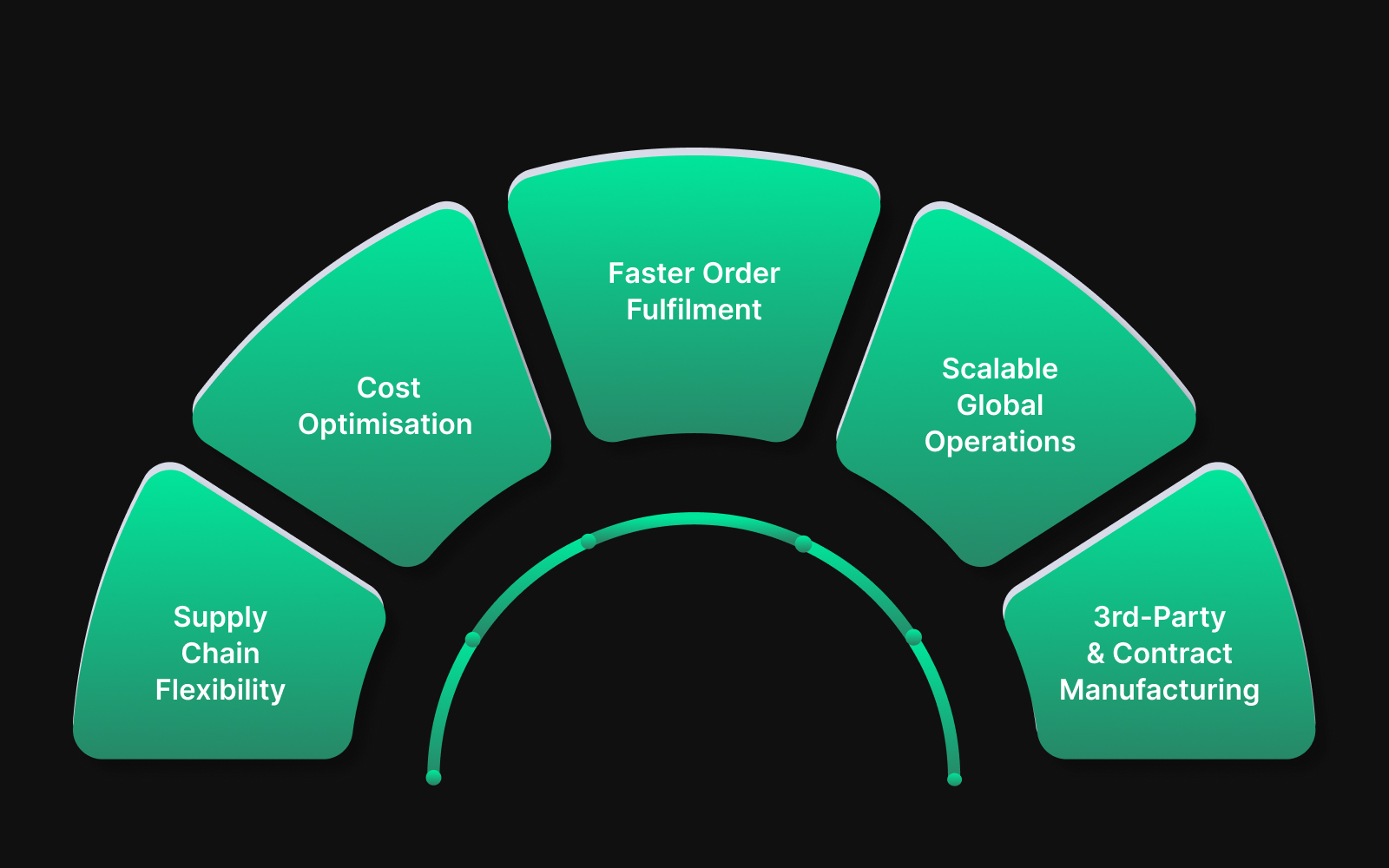

By bridging operational needs with strategic business objectives, this model offers multiple advantages:

1. Supply Chain Flexibility: Businesses can ship goods directly to the required location without modifying commercial contracts, ensuring smooth operations across diverse markets.

2. Cost Optimisation: Direct delivery reduces unnecessary handling, storage, and transit expenses, helping businesses save on operational costs.

3. Faster Order Fulfilment: Products reach their destinations more quickly, improving customer satisfaction and supporting stronger buyer relationships.

4. Scalable Global Operations: Companies can expand into new markets without immediately setting up local billing entities, making global growth more manageable.

5. Support for Third-Party and Contract Manufacturing: The model accommodates distributors, regional warehouses, and contract manufacturers efficiently, enabling seamless coordination without complex billing arrangements.

By integrating flexibility, cost efficiency, and scalability, the Bill To Ship To model provides a practical framework for businesses to understand the complexities of international trade.

Also read: Essential Shipping Documents Every Importer and Exporter Should Know

Key Stakeholders in the Bill To Ship To Model for International Shipping

Once you understand the Bill To Ship To structure, the next step is identifying all the parties involved. Each participant has a critical role in ensuring the shipment moves smoothly and complies with international trade regulations.

To make this model work effectively, it’s essential to clearly define the roles of each party:

1. Exporter or Supplier

The exporter manufactures or supplies the goods and issues trade documents in accordance with the agreed billing and delivery arrangements. Accuracy at this stage is vital; errors in documentation can delay shipments or trigger customs inspections.

2. Bill-To Entity

This is the party legally responsible for payment. Appearing on commercial invoices, the bill-to entity is usually the contractual buyer. They typically oversee:

- Contract terms and pricing

- Currency and payment obligations

- Tax liability in relevant jurisdictions

Clear identification of the bill-to party helps prevent disputes and ensures timely financial reconciliation.

3. Ship-To Entity

The ship-to party is the physical recipient of goods, listed on shipping documents such as packing lists, bills of lading, and delivery instructions. Correct designation avoids delivery delays, customs issues, and logistical confusion. Accurate ship-to details are essential for:

- Smooth customs clearance

- Correct delivery to the intended location

- Compliance with local import regulations

Any mismatch between bill-to and ship-to information can lead to delays or penalties.

4. Logistics and Customs Authorities

Freight forwarders, carriers, and customs officials verify that documents align with the physical movement of goods. Coordination between all parties ensures that shipments are compliant and delivered on time.

After identifying the key stakeholders, it becomes easier to see how a bill to ship to transaction moves from order placement to final delivery commitments.

How the Bill To Ship To Model Works: Step-by-Step Process

In global trade, the Bill To Ship To model allows one party to pay for the goods while the other receives them. This structure provides flexibility for international supply chains and ensures operational efficiency.

Understanding each step helps prevent compliance issues, minimise delays, and strengthen trade performance.

Step 1: Order Placement

The bill-to party places an order with the exporter and specifies the ship-to address, product details, quantity, delivery schedule, and Incoterms. Accurate order information ensures that finance, logistics, and operations teams are aligned from the start.

Impact: This reduces errors in shipment planning, prevents costly delays, and creates a predictable supply chain.

Step 2: Invoice Preparation

The commercial invoice lists the bill-to party as the buyer while clearly identifying the ship-to party as the consignee. Tax, currency, and pricing details are aligned with the bill-to entity.

Impact: Proper invoicing ensures compliance with customs and tax regulations, avoids penalties, and supports timely payment processing.

Step 3: Shipment Execution

Goods are dispatched directly to the ship-to location, and shipping documents reflect the recipient while referencing the bill-to entity where required.

Impact: Direct delivery reduces handling costs, shortens transit times, and improves customer satisfaction by ensuring goods arrive at the right location efficiently.

Step 4: Customs Clearance

Customs authorities verify that invoices, packing lists, and transport documents match the declared transaction structure.

Impact: Correct documentation reduces inspection delays, prevents fines, and ensures seamless border crossing, maintaining the reliability of the supply chain.

Step 5: Payment Settlement

The bill-to party pays under the contract, even though the goods are delivered elsewhere.

Impact: This separation maintains financial accountability, secures cash flow for the exporter, and allows the ship-to party to receive goods without complications, improving overall business trust and operational stability.

Step 6: Post-Shipment Monitoring

Exporters track shipments and confirm delivery to the ship-to entity against the original order and invoice.

Impact: Continuous monitoring ensures accurate records, enables rapid resolution of discrepancies, and provides insights for optimising future logistics, enhancing reliability and operational efficiency.

Also read: 7 Steps to Streamline and Improve Your Supply Chain Process

With the transaction flow in place, documentation becomes the critical control point where accuracy determines whether shipments move smoothly or face delays.

Role of the Bill To Ship To Model in Global Trade Documentation

Documentation is often the point at which bill to ship to transactions succeed or fail. When the entity paying for the goods differs from the one receiving them, every document must accurately reflect this structure. Even small inconsistencies across invoices, shipping papers, or regulatory filings can lead to clearance delays, tax disputes, or audit scrutiny.

The table below summarises the key documents, their focus, and critical points to note:

By systematically aligning all trade documents with the bill-to and ship-to structure, exporters can minimise errors, avoid penalties, and maintain operational efficiency across global supply chains.

Essential Tax and Compliance Considerations Under the Bill To Ship To Model

Exporters need to maintain precise invoicing, accurate shipment records, and compliant documentation to ensure seamless customs clearance and minimise the risk of penalties. Clear knowledge of regulatory requirements at each stage is essential for smooth operations and accurate financial management

1. Place of Supply Rules in Bill To Ship To Transactions

The place of supply determines which jurisdiction has the right to levy taxes. In bills-to-ship-to arrangements, this can become complicated due to the separation between the party paying for the goods (bill-to) and the party receiving them (ship-to).

For Indian exporters, factors influencing place-of-supply determination include:

- The location of the bill-to party

- The location of the ship-to party

- The type and nature of goods

- Whether the movement is domestic or an export

Impact: Correctly identifying the place of supply ensures that GST or export benefits are applied properly, preventing disputes or penalties.

2. GST Implications in India

Domestic bills-to-ship-to transactions require careful GST calculation. Liability may shift based on the ship-to location, and misinterpretation can result in:

- Incorrect tax payment

- Blocked input tax credit

- Increased audit exposure

Impact: Maintaining clear, order-level data and aligning billing with delivery details helps businesses avoid financial losses and ensures compliance with Indian tax authorities.

3. Cross-Border VAT Considerations

For exports, compliance extends to international VAT rules. Exporters must ensure that invoices and shipment documentation clearly indicate zero-rated supply when applicable. Authorities often scrutinise bills-to-ship-to transactions to prevent tax leakage.

Impact: Proper documentation safeguards eligibility for tax exemptions, accelerates customs clearance, and reduces the risk of audits in destination countries.

4. E-Way Bill and Compliance Requirements

In India, e-way bills are mandatory for the movement of goods above specified thresholds. Key considerations include:

- Accurate ship-to address

- Correct invoice references

- Consistency between vehicle and consignment details

Any discrepancy between the invoice and the e-way bill can trigger penalties or transit delays.

Impact: Ensuring consistency between invoices and e-way bills helps prevent fines, avoids shipment delays, and improves operational reliability across supply chains.

5. Legal Framework and Trade Agreements

The bill to ship to the model is recognised under multiple frameworks: GST laws, customs regulations, and international trade agreements. However, enforcement can differ across countries. Exporters must:

- Align contracts and Incoterms with legal requirements

- Ensure documentation adheres to trade agreements

- Consider regional compliance variations

Impact: Adhering to the legal framework protects exporters from disputes, supports smooth cross-border operations, and strengthens credibility with international partners.

Even with the right structure and documentation, practical challenges can arise when controls are not consistently applied across teams and systems.

5 Major Challenges and Best Practices in the Bill To Ship To Model

While the Bill To Ship To model enables flexible global trade structures, it also introduces operational and compliance risks. Since billing, payment, and delivery involve different parties, even small gaps can lead to delays or regulatory scrutiny.

Below are the key challenges businesses face, along with proven best practices to manage them.

1. Inconsistencies Across Trade Documentation

When the buyer and consignee are different entities, discrepancies often arise between commercial invoices, packing lists, and transport documents. These inconsistencies can trigger customs queries or shipment delays.

Best practice: Use standardised document formats and ensure bill-to and ship-to details are defined clearly at the order stage and carried through every export document.

2. Incorrect Tax Classification and Liability

Misinterpreting the taxable party or place of supply can result in incorrect GST or VAT treatment, exposing exporters to penalties or reassessments.

Best practice: Bring the tax and logistics teams together early to validate the transaction structure, tax responsibilities, and invoicing before shipment execution.

3. Gaps in Customs and Regulatory Compliance

Authorities may question valuation, ownership transfer, or transaction intent if the commercial structure is not clearly documented.

Best practice: Maintain complete, order-linked records that clearly explain contractual relationships and support customs declarations.

4. Increased Audit Risk

Dispersed records and manual tracking make it difficult to defend Bill To Ship To transactions during audits or post-clearance checks.

Best practice: Digitise transaction tracking so orders, documents, and shipment data remain accessible and audit-ready in one system.

5. Misalignment Between Internal Teams

Sales, finance, and logistics teams may work with different assumptions, increasing the risk of execution errors.

Best practice: Operate from a single, shared order-level system that keeps commercial terms, tax logic, and logistics data aligned end to end.

How Pazago Supports Bill To Ship To Shipments During Execution

Bill To Ship To transactions increase execution risk because billing responsibility and physical delivery are split across parties. While the documentation structure may be clear on paper, issues usually surface during shipment execution, especially around freight planning, container booking, loading coordination, and shipment visibility.

Pazago supports exporters using the Bill To Ship To model by strengthening logistics execution, where errors most often occur:

- Competitive freight rates across key trade lanes, helping exporters plan shipments predictably across multi-party delivery structures.

- Assured container booking and coordinated loading at factory, CFS, or port, aligned to the Ship-to location and delivery commitments

- Daily Status Reports (DSRs) covering container movement, ETD/ETA changes, transshipment updates, and BL status, keeping all parties informed during transit

- Hands-on pre-shipment and post-shipment support to resolve coordination gaps between billing entities, consignees, and logistics partners

- Equal operational support for exporters of all sizes, including complex third-party and multi-location shipments

By tightening execution control at the logistics level, Pazago helps exporters reduce delivery delays and coordination breakdowns in Bill To Ship To shipments.

Conclusion

The Bill To Ship To model enables flexible global trade structures, but it leaves little room for execution errors. When billing and delivery are handled by different parties, shipment coordination becomes more sensitive to delays, miscommunication, and missed milestones.

In Bill To Ship To shipments, execution gaps emerge when freight planning, container availability, and loading schedules fall out of sync with delivery locations. Pazago closes these gaps with predictable freight rates, confirmed container bookings, coordinated loading, daily shipment updates, and direct shipment support.

FAQs About Bill To Ship To

1. How does the Bill To Ship To arrangement work in global trade transactions?

In a Bill To Ship Toarrangement, the entity responsible for payment is different from the party receiving the goods. This setup allows companies to separate financial responsibility from physical delivery.

2. When is the Bill To Ship To model typically used in supply chains?

This model is commonly used in centralised procurement, distributor-led fulfillment, and cross-border trading, where goods are shipped directly to warehouses, partners, or end customers.

3. What information must align across Bill-To and Ship-To records?

The invoicing party’s legal details must match commercial and tax records, while the delivery party’s address and contact details must match transport and customs documentation to avoid mismatches.

4. Does the Bill To Ship To model affect customs valuation or clearance?

Customs authorities may review differences between the Bill To Ship To during valuation checks. Clear documentation helps demonstrate the commercial relationship and reduces the risk of clearance delays.

5. Can Bill To Ship To be applied to all international shipments?

Not all countries or product categories permit this structure. Exporters should verify local customs rules and trade regulations before applying the Bill To Ship To model to a shipment.

.png)

%20Meaning%20and%20Export%20Planning.jpg)