Optimize your business: use unlimited savings with Pazago fulfilled now!

Get Started ->India's global trade continues to grow every year. In fact, according to recent data, the country's total exports reached $349.35 billion between April and August 2025, up from $329.03 billion in the same period last year. That's a 6.18% growth.

With this rapid growth, getting the shipping terms right matters more than ever. Two terms come up often in ocean freight negotiations: CFR and CIF. Both look similar on paper. But there's one critical difference that affects your costs, responsibilities, and protection during the shipping process.

In this guide, we break down CFR vs. CIF, covering everything you need to know about each term, how they differ, when to use each one, and how to choose based on your business needs. Let’s get into it.

Key Takeaways

- Insurance is the main difference: CIF requires the seller to provide marine insurance, while CFR does not require any insurance from the seller.

- Risk transfers at the same point: Under both CFR and CIF, risk moves from seller to buyer once goods are loaded on the vessel at the origin port.

- CIF offers basic coverage only: The insurance provided under CIF covers minimum risks, and buyers often need additional coverage for full protection.

- CFR gives buyers insurance control: With CFR, buyers arrange their own insurance policy, which can be more comprehensive and cost-effective for their needs.

- Choice depends on your situation: Your decision between CFR and CIF should consider your insurance needs, buyer-seller relationship, cargo value, and risk appetite.

What Are CFR and CIF Incoterms?

CFR and CIF are International Commercial Terms (Incoterms) published by the International Chamber of Commerce. These terms define the responsibilities of sellers and buyers in international trade transactions.

Both CFR and CIF apply specifically to ocean and inland waterway transport. They're among the most commonly used terms for sea freight because they clearly split responsibilities between seller and buyer at the port.

CFR stands for Cost and Freight. Under CFR, the seller pays for the cost of goods and freight charges to deliver cargo to the destination port. However, the seller does not provide insurance coverage for the goods during transit.

CIF stands for Cost, Insurance, and Freight. Under CIF, the seller covers the same costs as CFR, plus the seller must purchase minimum marine insurance coverage for the buyer's benefit during the sea voyage.

For example, let’s say you're exporting textiles from Mumbai to Hamburg. Under CFR, you pay for the goods and ocean freight to Hamburg port. Your buyer arranges insurance separately. Under CIF, you pay for goods, freight, and you also purchase marine insurance before the shipment leaves India.

CFR and CIF share many similarities, but each has distinct responsibilities. Let's start with CFR and see exactly what sellers and buyers handle under this term.

What Is CFR (Cost and Freight)?

CFR is an Incoterm where the seller delivers goods on board the vessel at the port of shipment and pays all costs to transport goods to the named destination port.

Under this term, the seller arranges and pays for ocean freight, export customs clearance, and all charges until the cargo reaches the destination port. The buyer takes care of import customs, destination port charges, and inland transport from the port to their warehouse.

Note: Under the CFR, the seller pays for freight, but risk transfers to the buyer much earlier. Once goods are loaded on the vessel at the origin port, the buyer bears all risks of loss or damage during the voyage.

Seller responsibilities under CFR include:

- Goods and commercial invoice: Provide goods as per the contract and issue a commercial invoice.

- Export clearance: Handle all export customs formalities and documentation at origin.

- Loading and freight: Load goods on the vessel and pay ocean freight to the destination port.

- Delivery notification: Inform the buyer when goods are loaded on board the vessel.

- Transport documents: Provide the buyer with proof of shipment, like the Bill of Lading.

Buyer responsibilities under CFR include:

- Insurance: Arrange and pay for marine insurance coverage if desired, as the seller provides none.

- Risk from loading point: Bear all risks once goods are loaded on the vessel at the origin port.

- Import clearance: Handle customs clearance and pay import duties at the destination.

- Destination charges: Pay for unloading, port fees, and inland transport from the destination port.

- Receipt of goods: Take delivery at the destination port and transport the cargo to the final location.

Example: You're importing machinery from China to Chennai under CFR terms. The Chinese supplier pays for freight to Chennai port. But if the machinery is damaged during the voyage, you bear the loss unless you arranged your own insurance policy separately.

CFR leaves insurance decisions to the buyer. CIF takes a different approach by adding insurance to the seller's responsibilities from the start.

What Is CIF (Cost, Insurance, and Freight)?

CIF is an Incoterm where the seller delivers goods on board the vessel, pays freight to the destination port, and also provides marine insurance coverage for the buyer during transit.

CIF includes everything CFR covers, plus one additional obligation: the seller must purchase minimum marine insurance on behalf of the buyer.

Note: Like CFR, risk still transfers to the buyer once goods are loaded on the vessel. The insurance is a protective measure, not a shift in risk responsibility.

Seller responsibilities under CIF include:

- Goods and commercial invoice: Provide contracted goods and issue an invoice to the buyer.

- Export clearance: Complete export customs and regulatory requirements at origin.

- Loading and freight: Load cargo on vessels and pay ocean freight to destination ports.

- Marine insurance: Purchase minimum insurance coverage (110% of contract value, Institute Cargo Clauses C).

- Insurance certificate: Provide the buyer with the insurance policy or certificate as proof of coverage.

- Transport documents: Issue Bill of Lading and other shipping documents to the buyer.

Buyer responsibilities under CIF include:

- Risk from loading: Bear all risks of loss or damage once goods are on board at the origin port.

- Additional insurance: Purchase supplementary insurance if the seller's minimum coverage is insufficient.

- Import clearance: Handle customs formalities and pay duties at the destination port.

- Destination costs: Pay for port charges, unloading fees, and inland transport to the final destination.

- Receipt and inspection: Take delivery and inspect goods at the destination port.

Example: You're exporting spices to the UK under CIF terms. You arrange ocean freight from Kochi to London and also purchase basic marine insurance covering 110% of the shipment value. Your buyer receives both the Bill of Lading and the insurance certificate, giving them some protection during transit.

So, now that you've seen what each term covers individually, let’s compare them side by side to see the main differences between them.

CFR vs. CIF: What Is the Difference?

The primary difference between CFR and CIF is insurance. Under CIF, the seller provides marine insurance coverage. Under CFR, the seller does not provide any insurance.

Both terms are nearly identical in all other aspects. The seller pays for freight to the destination port in both cases. Risk transfers to the buyer at the same point for both terms when goods cross the ship's rail at the origin port.

Here's how both terms compare:

The choice between CFR and CIF often depends on who can get better insurance rates and how much control the buyer wants over coverage levels.

When Should You Use CFR?

CFR works well when the buyer wants control over insurance arrangements or already has an insurance policy covering multiple shipments.

Here are situations where CFR works as a better option:

- Established importers with insurance policies: Large importers often have annual marine insurance contracts covering all their shipments at negotiated rates. They prefer CFR because additional seller insurance is redundant and increases costs.

- High-value or specialised cargo: When cargo requires specific insurance coverage beyond basic minimum terms, buyers prefer arranging comprehensive policies themselves rather than relying on the seller's basic coverage.

- Trusted trade relationships: In long-term supplier relationships where both parties understand responsibilities clearly, buyers often choose CFR to manage their own risk protection.

- Cost transparency: Buyers who want to see exact freight and insurance costs separately prefer CFR, allowing them to compare insurance options independently.

- Regions with competitive insurance markets: In countries where local insurance rates are lower than international rates, buyers save money by arranging coverage locally under CFR terms.

Example: A regular importer bringing electronics from Taiwan has an annual marine cargo policy with an Indian insurer covering all shipments. They negotiate CFR terms with suppliers because adding CIF insurance would duplicate coverage and increase costs unnecessarily.

Looking for better control over your shipping documentation and insurance coordination? Pazago helps you manage all your trade documents, communicate with insurers, and track coverage in one platform. Book a demo to see how we simplify CFR shipments.

CFR works well for certain buyers and cargo types. CIF serves a different set of needs, particularly for those who value convenience and basic coverage.

When Should You Use CIF?

CIF works well for buyers who want convenience and basic protection included in the purchase price, especially for first-time importers or smaller shipments.

Here are situations where CIF is appropriate:

- First-time importers: Buyers new to international trade may not have insurance contacts or knowledge. CIF provides automatic basic coverage, reducing complexity.

- Lower-value shipments: For cargo where comprehensive insurance isn't critical, the basic coverage under CIF provides adequate protection without extra effort.

- Simplified pricing: Buyers who prefer one inclusive price covering goods, freight, and insurance find CIF convenient for budgeting and comparison.

- Seller has better insurance rates: In some cases, experienced exporters with volume discounts on marine insurance can provide CIF at competitive total costs.

- Compliance requirements: Some buyers or their banks require proof of insurance before releasing payments. CIF satisfies this requirement automatically.

Example: A small retailer importing home decor items from Indonesia for the first time chooses CIF terms. The seller arranges freight and basic insurance, providing the retailer with a complete package. The retailer doesn't need to find an insurance broker or understand coverage details.

Choosing between CFR and CIF involves more than just insurance. Your decision between CFR and CIF should match your specific business situation and cargo needs.

How to Choose Between CFR and CIF for Your Business

Choosing between CFR and CIF depends on your experience level, insurance access, cargo characteristics, and relationship with your trade partner.

Ask yourself these questions:

- Do you have existing insurance arrangements? If you have an annual marine cargo policy, CFR makes sense. You avoid paying twice for insurance.

- Is this your first international shipment? If you're new to trade, CIF provides convenience and basic protection without extra effort.

- What is your cargo value and type? High-value or fragile cargo often requires comprehensive insurance beyond what CIF provides. In such cases, CFR with your own extensive coverage works better.

- Can you get competitive insurance rates locally? If local insurance companies offer better rates than what your seller charges, CFR reduces your total costs.

- What do your payment terms require? Some Letters of Credit require insurance documents. CIF automatically provides these, while CFR requires you to arrange and submit insurance certificates separately.

- How strong is your relationship with the supplier? Trusted long-term suppliers are often flexible with terms. You can negotiate CFR if it suits your needs better.

- What is your risk tolerance? Risk-averse buyers prefer CIF for automatic coverage. Confident buyers managing their own risk prefer CFR for control and potential cost savings.

Example: You're a growing exporter shipping garments to multiple countries. Initially, you use CIF terms because it's simple. As your volume increases, you negotiate an annual marine insurance policy with competitive rates. You then switch to CFR terms with all buyers, saving 15-20% on insurance costs while maintaining better coverage.

Stay on top of documentation, insurance certificates, and claims with Pazago. Track all documents, coordinate with insurers, and manage claims efficiently across all your shipments from one platform.

Making the right choice is half the work. Avoiding common errors with these terms protects you from unexpected costs and disputes down the line.

Common Mistakes to Avoid with CFR and CIF

Many exporters and importers make avoidable mistakes when working with CFR and CIF terms. Here are the most common ones:

- Assuming CIF means full protection: CIF provides only basic minimum coverage. Buyers often discover too late that common risks like theft or breakage aren't covered.

- Not reading the insurance certificate: Under CIF, always review the insurance certificate to confirm coverage scope, excluded risks, and claim procedures before accepting shipment.

- Forgetting to arrange insurance under CFR: Some CFR buyers assume the seller provides insurance because freight is covered. This leaves cargo uninsured during transit.

- Misunderstanding risk transfer timing: Both CFR and CIF transfer risk when goods are loaded on the vessel, not when they reach the destination port. Buyers are responsible for transit damage.

- Not communicating clearly: Disputes arise when buyers expect comprehensive insurance under CIF but receive only basic coverage. Always clarify insurance scope before finalising terms.

- Choosing based on price alone: The cheapest CFR quote isn't always the best deal if you need to pay high insurance premiums separately. Compare total landed costs.

- Ignoring documentation requirements: Letters of Credit and customs authorities need proper insurance documents. Ensure you have the correct paperwork under both CFR and CIF.

Example: An importer accepts CIF terms for machinery shipment. The cargo suffers water damage during unloading at the destination port. The claim is rejected because the seller's basic CIF insurance doesn't cover damage after vessel discharge. The importer loses INR 5 lakhs because they didn't purchase supplementary insurance.

Even with the right Incoterm choice, managing international shipments involves coordination across multiple parties and documents. That's where the right tools make a real difference.

Manage CFR and CIF Shipments Easily with Pazago

Whether you choose CFR or CIF, managing international shipments involves multiple parties, documents, and deadlines. Missing one detail can delay shipments, increase costs, or create disputes.

Export and import teams juggle freight forwarders, insurance brokers, customs agents, and buyers across different time zones. Communication happens through scattered emails, and documents get lost in inbox clutter.

Pazago brings everything together in one platform built specifically for export-import trade management.

Here's how Pazago helps you handle CFR and CIF shipments better:

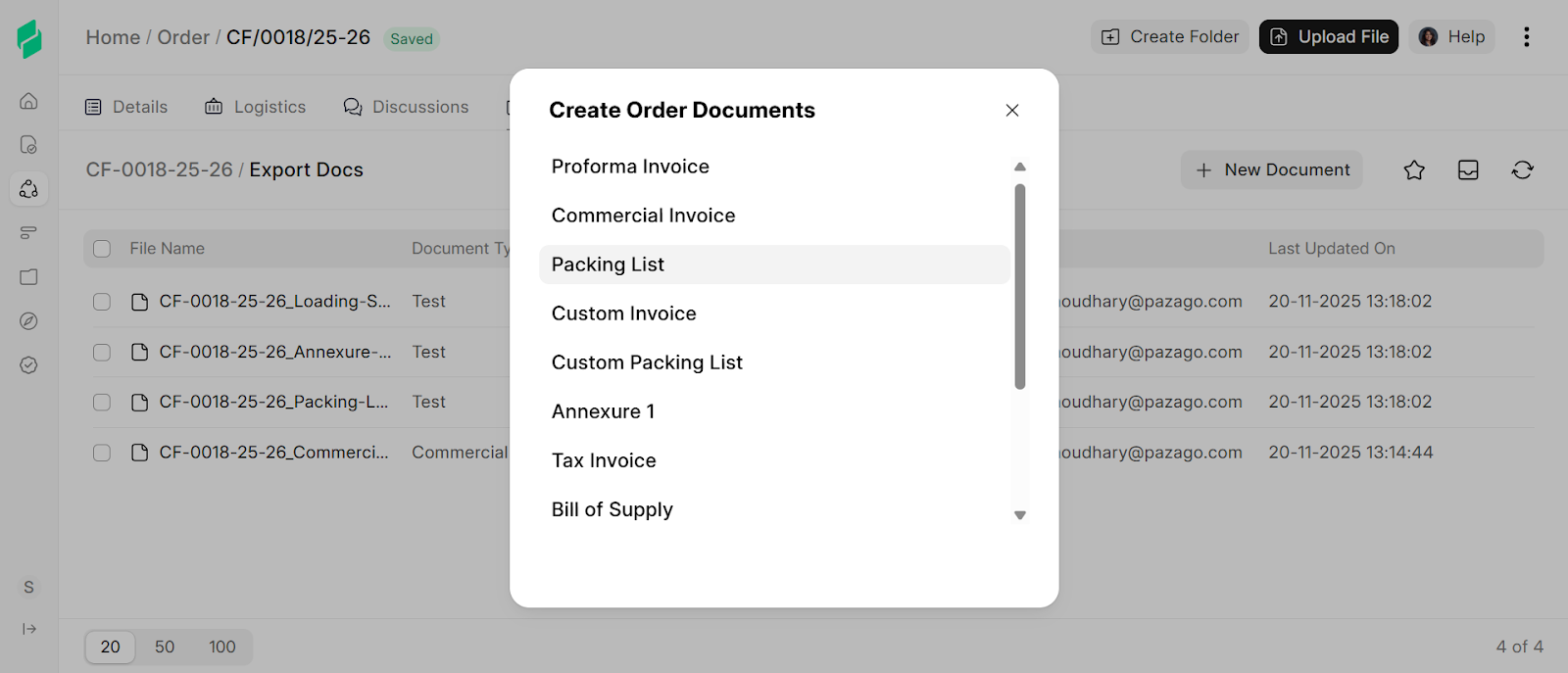

- Export document auto-generation: Generate commercial invoices, packing lists, and insurance certificates instantly using your order data to prevent mismatches.

- Customizable document templates: Apply logos and signatures to shipping documents with one toggle, removing manual printing and scanning steps.

- Order-level discussions: Coordinate with freight forwarders, insurance brokers, and buyers about CFR or CIF terms through shipment-specific conversations with team tagging.

- Critical shipment dates tracking: Monitor vessel departure dates, gate close times, and estimated arrival dates so you meet delivery obligations.

- Shipment tracking: Track your cargo and share tracking links directly with buyers so they can monitor shipment status themselves.

Pazago reduces manual work, improves accuracy, and helps your team focus on growing your business instead of chasing paperwork.

Final Thoughts

CFR and CIF are both practical Incoterms for ocean freight, with one key difference: insurance coverage. CIF includes basic marine insurance from the seller, while CFR leaves insurance arrangements to the buyer.

Your choice between CFR and CIF should match your business needs, insurance access, cargo type, and relationship with trade partners. First-time importers often prefer CIF for simplicity. Experienced traders with existing insurance policies typically choose CFR for better control and potential cost savings.

Both terms transfer risk at the same point, which is when goods are loaded on the vessel. Knowing this helps you make informed decisions about insurance coverage, claims procedures, and cost allocation.

Ready to manage your CFR and CIF shipments with complete visibility and control? Pazago helps you track shipments, manage documents, coordinate with all parties, and handle every aspect of your international trade in one platform. Book a demo today and scale your trade processes with confidence.

FAQs

1. Is CIF insurance coverage sufficient for all types of cargo?

No, CIF provides only basic minimum coverage under Institute Cargo Clauses (C), which covers major incidents like sinking or fire. It excludes common risks like theft, breakage, or water damage. High-value or fragile cargo needs additional insurance coverage.

2. Can I negotiate insurance terms separately under CIF?

Yes, you can negotiate with the seller to provide broader insurance coverage than the minimum CIF requirement. However, this increases the seller's costs and the quoted price. Many buyers prefer CFR terms and arrange comprehensive insurance independently.

3. Which Incoterm is better for first-time importers, CFR or CIF?

CIF is generally better for first-time importers because it includes basic insurance coverage automatically. This reduces complexity and provides some protection during transit without requiring the buyer to understand insurance markets or find insurance brokers.

4. Can I switch from CIF to CFR mid-contract?

Switching Incoterms mid-contract requires agreement from both buyer and seller. Any change should be documented in writing as an amendment to the original sales contract to avoid disputes about responsibilities and costs.

6. What happens if goods are damaged during transit under CFR?

Under CFR, the buyer bears the risk of damage once goods are loaded on the vessel. If the buyer did not arrange insurance separately, they absorb the full loss. If they purchased insurance, they file a claim with their insurance company for compensation.

.png)